👋 Welcome to all rockstar founders! This guide will help you navigate through the scene of pre-seed funding in The Netherlands and empower you to find the best fitting early-stage investor.

💸 Raising Pre-Seed Funding: Check Out the Interactive Version Here.

The earlier you raise capital, the more expensive it will be. We always advise founders to bootstrap through the launch of the business. This will give you the opportunity to build an MVP, validate demand, pivot a few times, and find your product-market-fit without the pressure of external investors. However, we know this is easier said than done…

If raising capital is crucial for the business, we would always advise founders to go for convertible notes as this postpones the valuation discussion. In this guide to pre-seed funding in The Netherlands, we segmented different types of investors, including the Family, Friends & Fools, Business Angels, government-funded funds, funds associated with accelerators and incubators, as well as VCs that invest in pre-seed stages. ****

Most investors stay on board for a fairly long time (between 5 to 10 years on average). Therefore, we highly encourage founders to do proper investor Due Diligence. This will ensure that you know what your investor can bring to the table (besides capital). With the current market, you can be as demanding about your investor as they are about the investment.

👨👩👧👦 FFF – Family, Friends & Fools

The first, and most easy way, to raise initial pre-seed funding in The Netherlands is from acquaintances. In the finance world, we describe the first line of support as the 3F’s: Family, Friends & Fools. You should be able to build conviction with this group as, after all, they know you like no one else does. But be wary – early-stage investing is a risky business and you don’t want to ruin Christmas parties if things turn south.

If you do not have a rich uncle or wealthy friend don’t be discouraged. There are a lot of (wise) fools out there that you might convince based on your team’s skillset, early proof, and amazing business opportunity. Think about your former professor at University, the owner of that fancy restaurant, or former colleagues and/or managers that know how you operate.

😇 Business Angels

Another way to raise pre-seed funding in The Netherlands is via Business Angels. These investors are high net worth individuals, mostly ex-founders, and want to support the ecosystem whilst generating a nice return on investment. The best way to find a suitable angel investor is via warm connections (or warm referrals). Look through your personal network and (re)connect with potential relevant people. Try to find your ambassadors or people that can relate to your proposition. You could for example think about your former employer, a successful former business owner, or a relevant stakeholder in the market. The best angels add value through personal knowledge, experience, or network (e.g. industry, business model, growth stage)

Not a strong network? Approach people from the industry that know about the problem you’re going to solve. Just make sure they invest on a personal (holding) level and not on a strategic level with their business entity. The latter will scare off venture capital investors as this will limit the exit potential of your business.

To support founders in their search of relevant angel investors, there are a few Angel Collectives and online platforms that match founders with investors ➡️

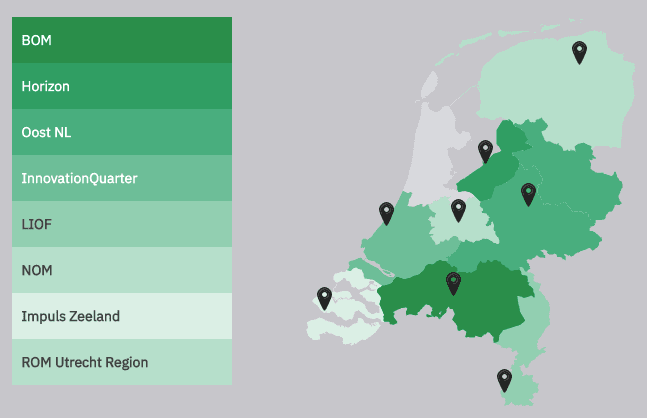

🗺️ Regional Funds

To support the local Dutch start-up ecosystem, the government established regional funds. As these funds have the mission to enhance the local economy they tend to take on more risk and go for early-stage investments. As a pre-seed founder, this could be an interesting way to get your first funding in.

👀 Find your local ROM (Regionale Ontwikkelingsmaatschappij) here:

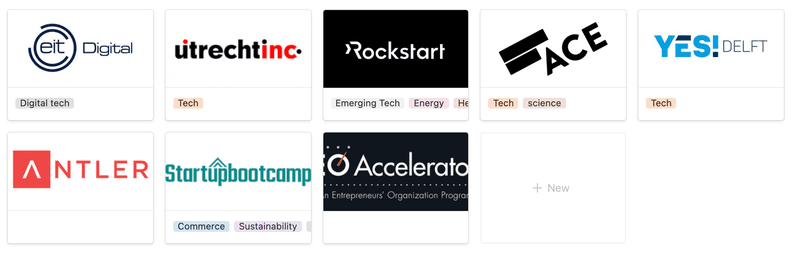

🏎️ Accelerators / Incubators

Accelerator and incubator programs support early ventures with network, knowledge, and physical resources (e.g. office space). Besides sweat equity, there are accelerators that have a venture fund and invest small initial tickets.

The top Dutch incubator and accelerator programs:

👩🏽🎓 Student funds

Are you a Dutch student or a recent graduate? Then it might be interesting to reach out to one of the student funds out there. Student funds are there to support their local ecosystem and are related to the local university. In the Netherlands, we have three with a strong reputation:

🚀 Venture Capital

There is a clear trend of VCs stepping in earlier than ever. Also at Peak, we closed some investments at the pre-seed stage. Although VCs invest pre-revenue, they often want to see the first validation of customers. This being an MVP, a launching customer(s), or 10k+ MRR depending on the profile and the risk appetite of the fund. The very early investment decisions of VC fund are purely based on the conviction in the team and the thesis. But the more validation you have – the easier it will be at most likely better terms.

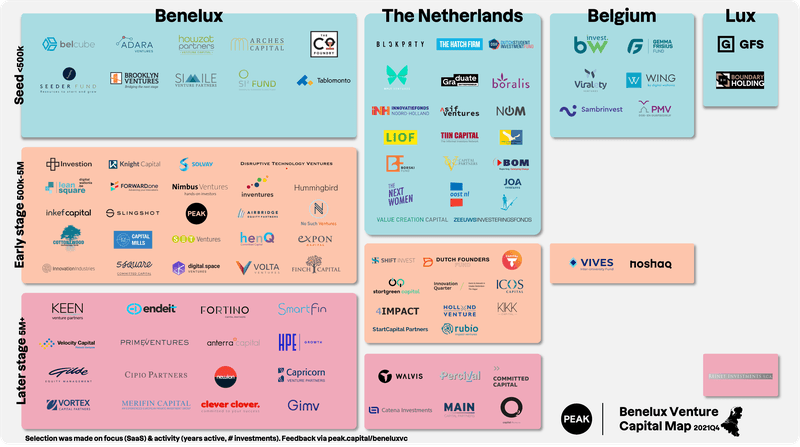

When selecting the best fitting VC, keep in mind the positioning of the different funds:

- 🇳🇴 🇳🇱 🇩🇪 Geography

- 💎 Industry or Business model expertise

- 💸 Ticket-sizes

- 🤝 Active support vs non-active support

- 👥 Network

- 🐋🐟 Lead investors vs co-investors

To demystify the (tech) VC landscape we published a map setting out the different stages and the Benelux corresponding investors:

🌋 About Peak

We are an early-stage venture capital fund based in Amsterdam backed by founders – with the scars to prove it. We invest EU-wide and have active investments in the Benelux, DACH, and Nordic regions. We are 100% funded and ran by experienced entrepreneurs.

Focus: SaaS, Marketplace, and Platforms

Stage: Pre-Seed-Seed-Series A

Ticket Size: EUR 250k-4M initial ticket size (with the firepower to follow on!)

Values: Eye-to-eye conversation, transparency, complimentary teams… and a good sense of humor.

Check out our website / our blog / our portfolio / and get in touch

Browse our other landscapes >>

Meet our Benelux team!

Ready to raise your first VC funding round? or do you have a prompting question? Feel free to reach out via this link or send a direct message:

👱🏼♀️ Tessa van der Geer

Tessa joined Peak one year ago as an Analyst. Previously she worked in a start-up herself, Whoppah, a second-hand marketplace for art and design. She wrote her Master Thesis about the gender investment gap in start-up funding and that’s how she got introduced to the VC scene. Together with Thijs, she is responsible for scouting the best opportunities in the Benelux.

> Tessa van der Geer – [email protected]

👱🏻♂️ Thijs Dijkman

Thijs is an Investment Manager at Peak and is responsible for sourcing investment opportunities in the Benelux. Over the past 4 years, he has led various investments ranging from Consumer Marketplaces to B2B Enterprise SaaS businesses.

> Thijs Dijkman – [email protected]

🚨Suggestions?

The guide to pre-seed funding in The Netherlands is an ever work in progress, feel free to do suggestions on how to improve this link.