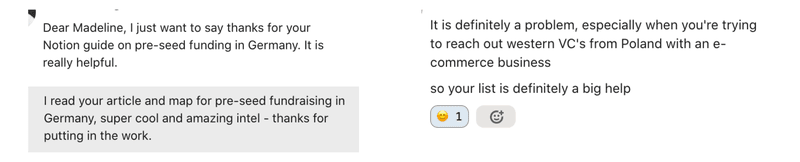

Exactly one year ago, I published the Pre-Seed Guide to Germany. I’ve been so happy to hear from founders that this guide helped them to meet investors and close their pre-seed round. It’s also been an awesome way to meet day 1 founders who find the guide and reach out.

Since then, I’ve moved to Germany (hit me up if you’re in Berlin!) and continued meeting and learning about the DACH “ecosystem.” Through countless handshakes, coffees, and pitch decks, I’ve learned more about the region in a few months than I did in the one year covering DACH from Amsterdam.

But I know that I have only scratched the surface. Every time I learn something new I am reminded of how large the iceberg is and how little of it I can – and will – ever see by myself. I can only imagine how confusing and complex it is as an ‘outsider’ or founder.

In the spirit to bring more transparency and clarity to a black box industry, I’m excited to present the rough draft of a new and extended landscape:

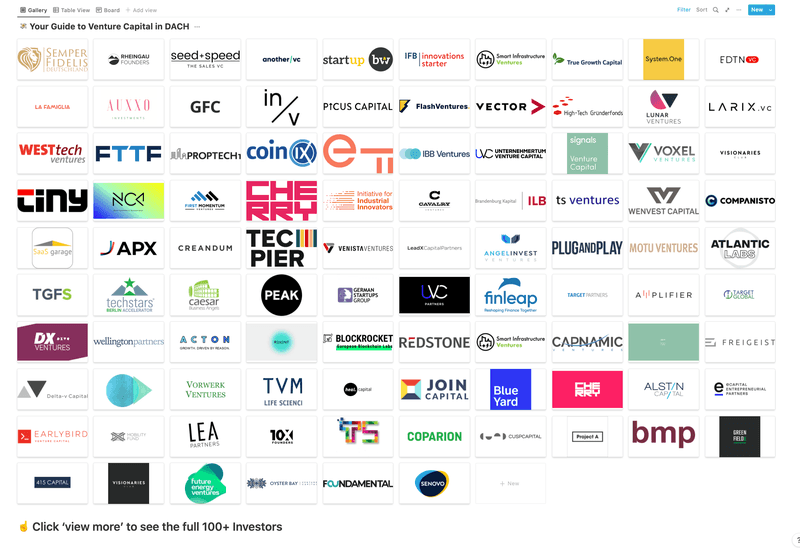

🚨 Your Guide to Venture Capital in DACH (Germany, Austria, and Switzerland) 🚨

How to use the Guide

- 🚨 Go to the interactive version -> here 🚨

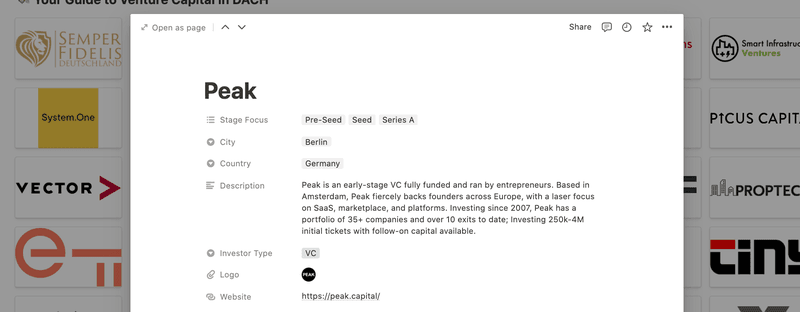

- Filter by stage, country, or focus sector (not fully complete yet)

- For a snapshot overview, scroll down 🙂

- Give feedback on how to improve!

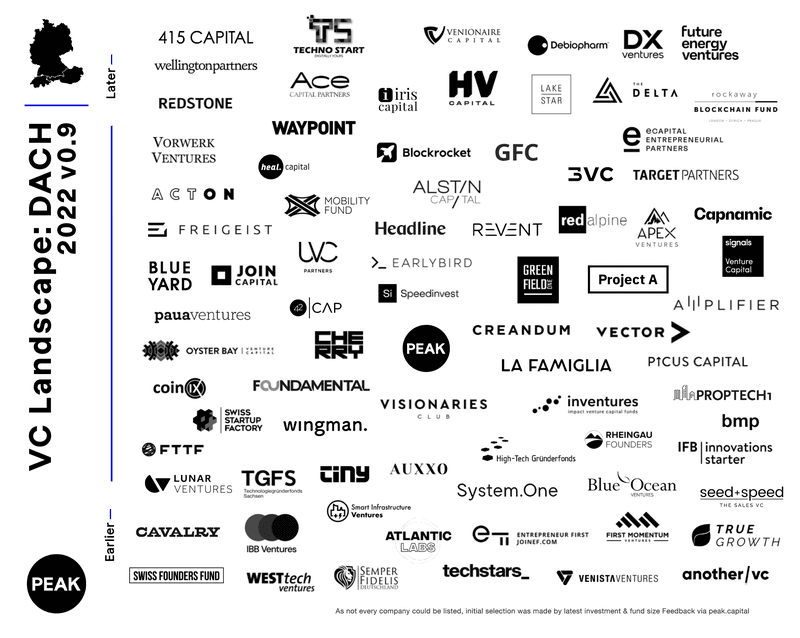

Landscape Snapshot

In case you prefer a static or printable version, we threw together this landscape and sorted the investors by ‘earlier’ to ‘later.’ Note: this is not exact as many funds invest across stages, but we hope it gives a general feeling for how the early → late-stage investor spread is in Germany, Austria, and Switzerland.