What is an LP in Venture Capital?

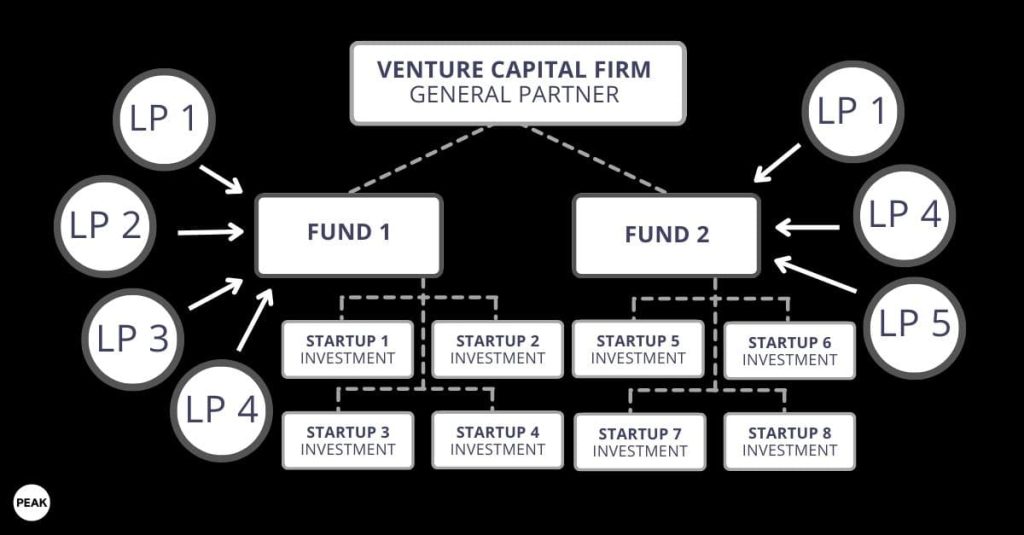

A limited partner (LP) is crucial for venture capital because they provide the capital for venture funds to make investments. The goal of a Limited Partner is to benefit from the relationship by profiting from the fund and sometimes gaining access to information and potential deals. They have no day-to-day control over or involvement in the venture fund.

Who Are The Limited Partners?

The limited partners can theoretically come from any background and have various legal forms. Typically, the main types of limited partners are high-net-worth people, wealthy families, pension funds, and sometimes sovereign wealth funds.

At Peak, all of our funds are backed 100% by seasoned entrepreneurs. They come from a wide range of industries stemming from manufacturing and logistics to tech Unicorns. Bringing with them lived experience, market expertise, and network.

How many limited partners can a venture fund have?

There is no limit on the number of Limited Partners that are investing in a venture fund. The numbers range from 10 to even 100 LPs in a venture fund. The average is about 10 to 20 LPs depending on the size of the fund and the amount of money to raise.

The Limited Partnership Agreement

The Limited Partnership Agreement (LPA) outlines the rules and regulations the limited partners should follow while making the investment or signing for funding. The agreement specifies the different procedures for topics such as how a partner is added to a given group or withdrawn. Also, it specifies the privileges each partner has, and the range of permitted actions. It also specifies how investors should contribute, the distribution of earnings among the group, and how the voting process will be.

The LPA also states the percentage of the partnership that each partner holds or other partnership interests. Usually, the percentage relates to how much each partner has contributed to the partnership.

How Do Limited Partners Profit From Their Investment?

A Limited Partner will be able to profit from their investment during a liquidity event. Examples of liquidity events are an initial public offering (IPO) and acquisitions by corporations or private equity firms.

It can take about 7 – 10 years before an LP sees a return on its investment. This is because it takes a lot of time before a startup will be able to have a big exit.

What is the Difference Between a Limited Partner and a General Partner in a Venture Fund?

The LPs that invest in venture capital funds are silent or passive investors. The general partner (GP) manages the venture capital fund. A general partner decides which ventures to invest in and usually takes a board seat at the company after the investment has been done.

Summing it Up

A limited partner provides the capital to the venture capital fund. Limited partners also have the opportunity to bond with other investors that are part of the venture fund. In some circumstances, this can offer helpful access to potential future investment possibilities for the limited partner and the venture capital firm.