Since leaving MessageBird to join Peak as its first Entrepreneur in Residence three months ago, I’ve been asked to assess the products (and product strategy) of numerous early-stage startups.

While the Product and Product Marketing experience I gained at the Dutch Unicorn is useful for quick assessments, I’ve found that having a score-based framework is incredibly useful for benchmarking opportunities at scale.

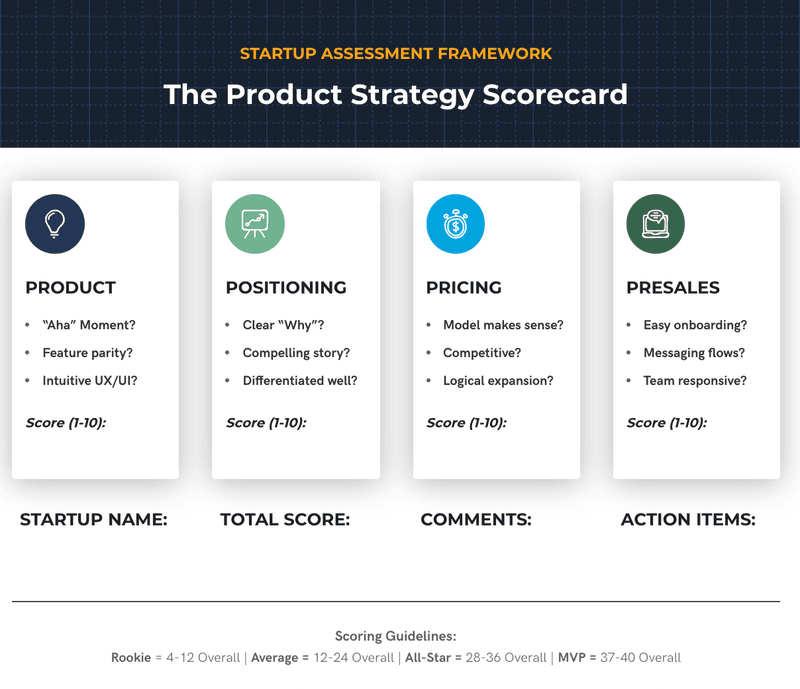

In this post, I’ll show you how to evaluate investment opportunities (and company strategy) using what I call “The Product Strategy Scorecard”.

In future posts, I’ll dive further into how startups can improve their “scores” for each of the 4Ps, both from the eyes of an investor and potential customer. I’ll also write more about how a top-down go-to-market (GTM) strategy requires different review criteria.

Building Upon Peak’s T-Score Model

Peak already uses four key criteria when reviewing investment opportunities in early-stage startups. They are affectionally referred to as “The 4Ts” – Team, Traction, Thesis & Timing.

I’ll leave a breakdown of how Peak’s evaluation process works to one of my other colleagues. But for context, every opportunity that fits our investment scope is reviewed and given a T-Score by an Analyst or Associate.

After a few more introductory stages are completed, I’m often asked to make an assessment of the company’s product offering and GTM strategy. For that, I’ll typically head over to the company’s website to mark down my first impressions, much like a potential customer would as they review new software vendors.

To help structure my feedback, I use “The Product Strategy Scorecard”

The 4Ps of Product Strategy

Like the 4Ts that go into creating a T-Score, I utilize four sets of criteria to help calculate a total assessment score. While there are more than 4 variables that go into creating a strong GTM strategy, experience tells me that the most important parts of product strategy are — Product, Positioning, Pricing & Presales.

P1 | Product: The actual software or hardware a tech company is building and selling.

You can typically review it via a self-service trial or a sales assisted demo. In cases where coding or more advanced account setup is required, watching getting started videos or reading use cases can suffice for the initial review.

P2 | Positioning: Getting your positioning right is key for compelling new users to sign up and growing a funnel.

Startups should focus on showing how they solve problems, what kind of customers they can help, and why their product is a better alternative to other options in the market.

Scores are generally based on a company’s website or submitted pitch deck, but also can be based on how founders pitch their vision in online videos or calls. If I want to see how the startup is resonating with customers, I’ll often head over to one of the various software review sites to read reviews.

P3 | Pricing.

Most bottom-up SaaS startups will openly share pricing online as offering lower rates is one of the most common ways they can initially win business from feature-rich competitors.

While the actual prices in relation to the market are important to consider, the actual GTM business model a startup shares in a pitch deck can often provide better scoring insights than its published pricing and feature lists.

P4 | Presales: Presales is probably the least obvious P on the scoring list. I think of it as the holistic process a startup uses to turn you into a paying customer.

Presales basically start from the time a customer starts their first search for your website. (I consider things like awareness building to fall more under traditional marketing than product marketing.)

I’ll make sure to go into this P in more detail in a future post, but Presales related items that I check for are: website chat widgets/automations, how easy it is to get started on a self-service product, and communication quality (personal or automated) throughout the sales process.

Scoring Guidelines

To keep it simple, I use a 1-10 numbering range for each score. These scores can be quite subjective to whoever is assessing a product, but I base it mostly on the following:

🔴 Rookie (1-3): The product and/or website comes across as needing a bit more work before it’s ready to start attracting new sign-ups at scale.

🟡 Average Player (4-6): What I see reaches the main expectation levels of an early-stage startup, but there are clear areas for improvement.

🟢 All-Star (7-9): If I hadn’t known its stage, the quality of the website, product, and onboarding experience would have led me to believe the startup was much further along.

🏆 MVP (10): A website and product filled with various Aha! moments and a very compelling reason for customers to sign up. I’d want to champion this company almost solely based on this one part of their product strategy.

Photographer: Museums Victoria | Source: Unsplash

Why Your Product Strategy Score (P-Score) Matters

If you’re actively seeking funding, the primary reason to pay attention to your own 4Ps is that having both a high T & P score will greatly increase the likelihood of you securing backing, not just with Peak, but with nearly any investor you pitch to.

But in addition to doing an internal check to see if your product checks enough VC boxes, I could just as easily see startups utilising it with their own GTM teams to do a sanity check on whether their products, websites, marketing, and sales processes are far enough along to really start competing for new customers at scale.

What’s Your P-Score?

If you’re interested in creating a P-Score of your own, here’s how I recommend you calculate it:

- For each of the framework’s 4Ps, take an honest look at the current state of a company’s website content, product capabilities, and onboarding experience in relation to top competitors.

- Score on what potential customers/investors are evaluating today, not where you know it will be in the near future.

- Use the scoring grid as your own guide for internal benchmarking as well as keeping track of competition. As you go through the process, write down items that you think others do well or you know could be done better.

To help you calculate a P-Score, you can download a high-res version of the Product Strategy Scorecard Here.

What Your Total P-Score Means

In general, if a startup scores under 15 points in total, it’s probably going to be hard to convince me (and others) to champion a company for an investment unless it scores high on a T-Score type model or has some other unique unfair advantage.

If your score qualifies you as an All-Star (above 28), first of all, nicely done! Second of all, you’re probably at or nearing a stage where it’s time to seriously think about how you want to grow your company faster.

In some cases, that means seeking venture capital. In others, it may simply mean that you should increase top-of-funnel spend and efforts because your product strategy is at a strong enough level to convert those additional marketing leads to paying customers.

But to reiterate, this framework isn’t specifically designed to create a scoring competition. Instead, try to use it as a conversation starter with your own team on how you can potentially score quick wins while continuing to grow your customer base.

In Conclusion

As a final takeaway for my fellow entrepreneurs, remember that one of your own key “jobs-to-be done” is to determine how high you want to score in each of the 4Ps before you fully open up the floodgates in search of new customers and investors.

If your score is too low, you’ll likely find yourself falling short of a large number of your potential customers’ expectations. More likely than not, this will lead to a low number of conversions and/or high churn rates, both of which could end up ruining your VC investment opportunity. Or even worse, your entire startup.

But on the flip side, please don’t spend too much time or effort trying to score perfect 10’s in all of the 4Ps before reaching out to potential customers or investors. Because as Peak’s T-Score has validated over the years, getting your GTM “Timing” right is often the highest contributor to your startup’s future success.

Author’s notes:

- This is the first version of my Product Strategy Scorecard. It is, like many products, a work in progress. That’s why I would love to hear your feedback or pushback on Peak’s LinkedIn page!

- If you’d like me to share a P-Score analysis for your own startup/product, you can easily schedule a free introductory call with me by using my Calendly link: https://calendly.com/smalkworks.

About the Author

Pete Christianson is Peak’s first Entrepreneur in Residence and Founder of Smalkworks. Along with scouting for interesting European Startups in the CX space, he advises startups on product and go-to-market strategies.

Pete was MessageBird’s first Product Marketing Manager and served in other strategic product roles as it went from a bootstrapped startup of 35 Birds to a $3B Unicorn.

Before that, Pete was the 4th member of a Silicon Valley-based retail technology startup that was acquired in 2016. He recently completed his EMBA at Rotterdam School of Management, Erasmus University.

Click here to connect with him on LinkedIn.