The news is out. StuDocu has raised a whopping $50M Series B. How did they go from a part-time student hustle to a global marketplace with more than 15M monthly active learners?

The answer lies in 5P’s. Let me explain…

2P’s: Peak + Point Nine

6 July 2015: we just launched our third fund at Peak. I just joined the firm (well: ‘firm…’, Johan van Mil was there and I joined him). A cold inbound email from StuDocu founder Jacques Huppes with a deck: “Dear Mr. Bary, …” (Yes, now it is 2021. Emailing directly with first names is fine, I’d say). Main objective: world domination.

Meeting scheduled: why? Very early indicators of (potentially) very interesting unit economics in a big market + complete founding team (tech + commercial) + low burn. Quite a few players had tried something similar, but few succeeded (most of them raised sizable amounts before failing). Not StuDocu. They had been figuring out their model for a couple of years. Their model is simple: offer students high-value access to content created for them by fellow students at a low cost. The founders didn’t need to get rich by charging individual students high amounts. They want to offer a lot of value by making StuDocu accessible for everyone and make students learn better and faster on the basis of a massive amount of information. Users before revenue.

First-time founders and perseverance

I met Marnix Broer (now still CEO, as it should be) and Jacques in the common space of our WeWork office. They showed three graphs: growth of users at a Dutch university, and the initial signs of a Spanish and an Australian university. They just started in Spain and Australia. No revenues yet, but they were able to prove that they could attract users globally (quite handy if you want to grow a consumer business). By the way: they didn’t show the graph in Belgium, which – as we found out a bit later – didn’t show the same positive results (not everything needs to be perfect in the early days).

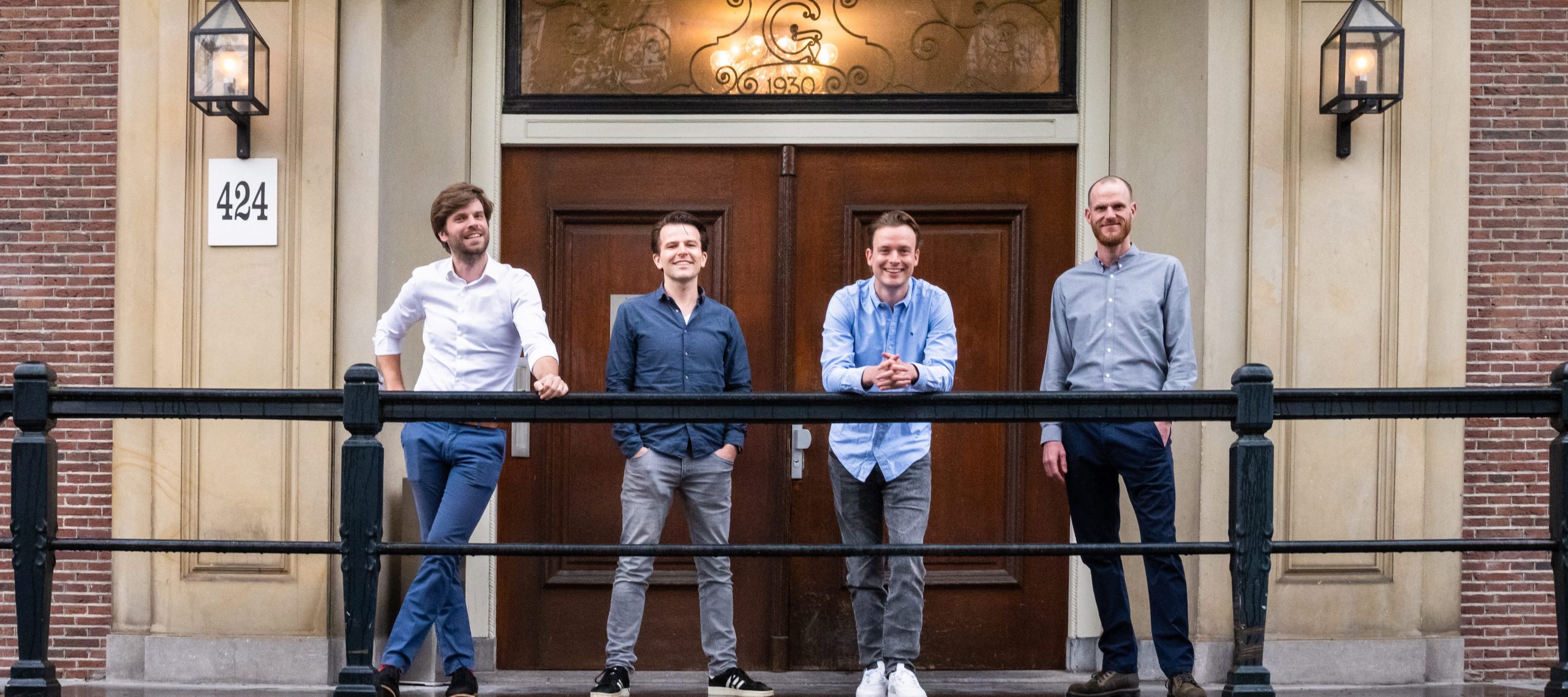

StuDocu wasn’t a new company at that time: they started in 2010 and the founders were already active with this “project” during their university days. Yes. First-time founders. But we felt a strong connection with all 4 of them: Marnix, Jacques, Lucas van den Houten and Sander Kuijk, and more importantly: that strong drive to world domination. (We love first-time founders; it just means they have to learn faster and they usually are very committed to do so.)

Our investment committee felt that the valuation we agreed to was high (remember those days when investors still had a say about the valuation 😉), but Johan and I were certain: this is a signature deal for us, perfectly representing what we want to invest in, being an early-stage marketplace and SaaS investor. Talk about #investor-startup-fit here.

We asked Point Nine to join the round. Having another pair of eyes and a broader network, especially such experienced eyes and a massive network as theirs, was a great asset to have on the cap table.

So then in each board session, the 2P’s joined.

From the start, it has been great cooperation: open, sometimes fierce, discussions. Implementing a lot of data insights. Conquering first 1k universities from the 40 when we invested, getting to 100k MAU, getting to 500k MAU, getting to 1M MAU, getting to 2M MAU… (This team can really celebrate success – don’t remember how many “X user parties” we have had.)

I believe one thing that is important for any startup, but even more so when launched by first-time founders, is to attract experienced team members. We were lucky that experienced people like Rasmus Wolff (GetYourGuide, Just Eat) and Reynald Fasciaux (Uber) joined StuDocu’s fantastic team (too many to mention individually, but you know who you are) in their path of scaling globally.

3P’s: Peak + Point Nine + Piton Capital

Other investors were seeing StuDocu’s success as well: in 2019 the network effects investor Piton Capital joined. We didn’t even publicly announce the round: if an underdog position serves you well, why not keep it?

So then our Whatsapp group with the team was renamed the “StuDocu 3P’s hotline”.

In our discussions, it has been very energizing that each investor could contribute their thoughts with the team, and the team could take whichever piece of input they felt was the most valuable.

4P’s: Peak + Point Nine + Piton Capital + Partech Growth

Apparently, the StuDocu team felt it could use some more “P-power”. The company has been growing like crazy: now active in more than 60 countries at more than 2k universities serving 15M+ MAU. Any successful business should at some point in time drop its underdog cover. That time is now.

We are very pleased to announce that Partech Growth joined as a Series B investor in StuDocu’s latest USD 50M Series B round.

So, Marnix, perhaps time to start a new Whatsapp group “StuDocu 4P’s hotline”? (Don’t just rename the 3P group… Partech might be able to see all past correspondence about when we were negotiating with them… 😉).

So, there you have it: Perseverance. Along the way, the StuDocu team gained the support of a few other Ps and learned some valuable lessons.

Lessons you (as a founder) might want to take with you…What do SaaS investors look at when investing?

- Cold emailing is fine: just make sure you target the investors that fit your company and nail the message.

- First-time founders – just do it: you can’t be born with experience. Just get the support around you and learn faster.

- Raise the right amount at the right time: some startups need big investments before they have product-market fit and can scale (deeptech, hardware). But if you can, get to early proof points before you raise the big amounts. Helpful in avoiding too much dilution. When you are ready to scale: raise!

- Show numbers: SaaS and marketplace investors do look at numbers. Anything you can show on traction (sales funnel, users, usage, retention, CLTV, CAC payback) should be known to you.

- Success doesn’t come overnight: perseverance is key. A startup never is a straight line going up, it comes with struggles that you just have to overcome. Hang in there!

- Find investors that really fit with you: each investor has its own field of expertise and way of working. Find the ones that know most about your field and that you believe you can benefit from the most, in a way that suits you.

Marnix, Lucas, Sander, and Jacques: Thanks for accepting our term sheet back in 2015, and looking forward to seeing what the next 5 years together will bring!

Looking for an investor or exit partner?

Get in touch with us! No warm intro needed 😉

For your convenience, I also attached the form below. You’re busy building a company – and we don’t want to keep you hanging. Using this form helps us to streamline our process and get back to you as quickly as possible. We look forward to knowing more about your big idea and the team making it a reality!