Somewhere on the bro’s map in between finance (and their fleece Patagonia vests), consulting (and their HP backpacks), and tech (and their cool caps and ginger shots), you can find the small Venture Capital village.

Venture Capital (VC) firms need to be powered by the willingness to evolve with their time, change when needed, and stay up to date. Otherwise, they die. That’s what makes them stand out from the typical finance crowd, and that’s why Clémence Luc, Early Stage Investor at Peak, is hopeful and optimistic about diversity in Venture Capital.

A few reasons why most junior VCs get excited about their jobs are: working with passionate founders, exposure to a large number of industries, the diversity of the job itself, the balance between strategy, execution, and creativity… it’s the one job in finance where the boring hierarchy doesn’t control your daily tasks and where you can actually have an impact from the most junior position.

Still here and want to know more? Good.

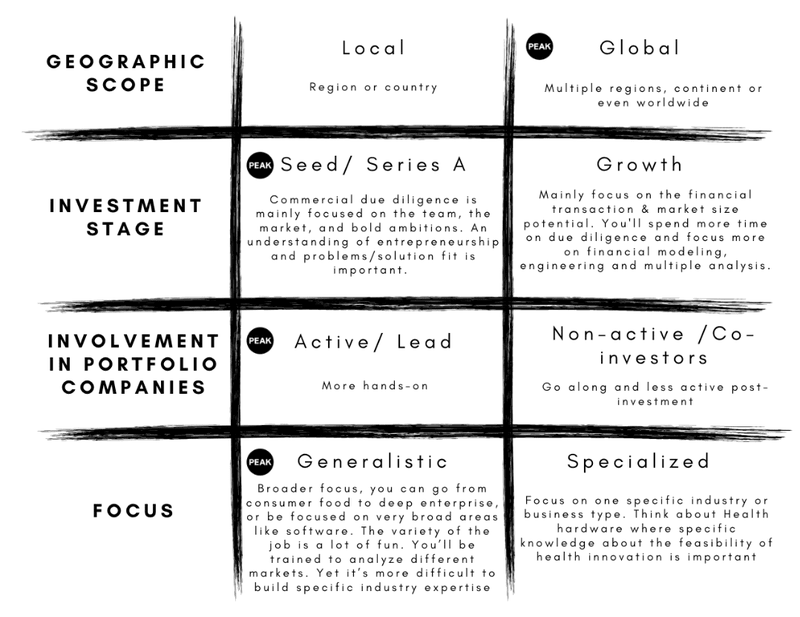

First things first, VCs come in different forms, sizes, and flavors. Different VCs require different skill sets. Let’s categorize by the following:

Peak checks the boxes of Seed, actively involved and specialised in SaaS and Marketplaces. They have offices in Amsterdam, Berlin, and Stockholm and are fully funded and run by experienced entrepreneurs. They use their extensive entrepreneurial DNA to support their founders on operational and strategic topics to bring them from Seed to Series A and beyond.

If you’ve decided you’re interested in early-stage VC, you’re in the right place. Here are a few tips on what VC investors look for and how you can break into early-stage VC.

- Show affinity with the startup and tech ecosystem 🤓

- Connect with the ecosystem 🧲

- Build your personal brand 📣

1. 🤓 Show affinity with the startup and tech ecosystem

According to Clémence, in early-stage VC, your study background is not relevant. Instead, they highly value big characters with a curious entrepreneurial mindset and a heart for the startup/tech ecosystem. So what exactly are they looking for?

Founder experience. Don’t worry, you don’t need to have founded Airbnb! Maybe it was not a startup, but a student association or anything else… Be creative to demonstrate your ability to undertake a project, build from scratch, strategise, and execute.

Start-up/scale-up experience. Understanding the culture, rapid-changing environment, and people are highly valuable to evaluate a company and talk to founders.

Industry knowledge. There is tons of content, podcasts, and books on which you can build your knowledge. Here are a few of Clémence’s favourites:

Two must-read books, in her opinion, are:

- The Power Law – Venture Capital and the Art of Disruption, by Sebastian Mallaby

- Venture Deals, by Brad Feld and Jason Mendelson

Newsletters are also a great way to know what’s hot. Here are a few examples recommended by Clémence:

- Lina’s newsletter

- Software Snack Bites

- Sunday CET and Overlooke

- Lenny’s newsletter

- NFX newsletter, they also have a very cool library

- Most VC funds also have a Medium page that they use to share their investment philosophy, explain why they invested in a specific company, or whatever insights they find relevant

Clémence is trying to be a podcast person, but she’s struggling with that, so instead she gathered recommendations from Peak’s team:

- All-in

- The 20mn VC

- Acquired

- Podcast: Big Exit Show,

- SaaStr

- The How to Start a Startup video playlist by Sam Altman

- Andrew Chen’s essays collection, partner at a16z

As you can imagine this list could go on and on and on…

2. 🧲 Connect with the ecosystem

If you have many VC and founders friends, good for you. If you don’t, here are a few tips.

Go to events, and be prepared. Find out who is going to be there, think about why they are relevant for you, and how can you be relevant to them? Be specific in your questions.

Meet with founders: a great way to gather insights (VCs’ reputation, investment processes, what they focus on in due diligence…)

Join a student fund. A few examples are G Ventures, ASIF, Graduate…

Reach out to VCs. Keep it short, specific, and ask for advice. Clémence was surprised with the quality and quantity of brilliant people who agreed to jump on a quick call and took the time to answer all of her questions, give advice, and offer feedback on her resume or elevator pitch.

You can also already do some research and write a short report that you can send to a VC regarding a sub-vertical or a company you find interesting. Think: What would make you answer to someone reaching out for advice?

3. 📣 Build your personal brand

VC is a job of marketing and sales with two types of customers: investors and founders. The entrepreneurial mindset/fit is thus of utmost importance. “Who do you want to be?”, and “what do you want to be known for?” are two major questions you should ask yourself.

Build your story. How you tell your story is almost as important as what’s in it. (tip: practice, practice, practice). Tell your story so that a company learns more about you than just the facts (don’t make a grocery list of your life events)

Show your entrepreneurial spirit. Have you built something? That’s great. Failed at it? Even better. How do you react when failing and under pressure? Demonstrate that you are proactive and take ownership of your projects: when you see opportunities for improvement in your job, you suggest and implement them.

Highlight your ability to adapt. 25 years ago you could wait for entrepreneurs to reach out and ask you to invest. Today, the market is way more competitive and you need to be out there. Show that you can manage, that you can re-learn what you know.

Establish your online presence. Being active, publishing content, reacting to others, and having an up-to-date profile are essential. LinkedIn is a must but also think of Twitter or Medium, for instance. Maybe you’ve built a community somewhere? Discord, Instagram? Great, use it.

Remember that as a junior VC, your main responsibilities will be to source and assess opportunities. Meaning scouting and finding deals and then being able to identify the most interesting ones. So why not start the job now? Find a few companies to pitch when you reach out or meet with VCs, and show that you are proactive and know what is expected of you!

There is no straight path, but one common characteristic: having a hustler mindset

There is no golden path to landing a VC job, no typical study background or specific internships required. Aim for the right position, most VCs use internships/ traineeships as a way to recruit analysts for instance. Once you land your first interview, make sure to prepare, prepare, prepare. What are their last investments? Pick a company that you love and one that you hate. Know the big exits made by the fund. Know where the partners are coming from. Show that you understand their investment thesis and that it matches who you are. Ask questions.

If you want to know more about what it’s like to work in VC, feel free to reach out to share some insights or ask additional questions! 🍻