The 8 reasons behind the gender investment gap in early-stage funding – and what you & I can do to close it.

A Personal story by Tessa van der Geer

My path to VC began with my MSc. thesis I wrote together with a fellow student at UCD Michael Smurfit (Dublin). She wished for a diversity topic which did not convince me right away. Coming from an entrepreneurial nest, I, on the other hand, am passionate about the start-up ecosystem. This led us to find a middle ground: ‘The gender investment gap in early-stage funding’.

The year is 2020. The US elected its first female Vice President. Female students outnumber and often outperform male students in universities. In the past 100 years, Women discovered nuclear fission and radiation, sent astronauts on the moon, and invented from central heating and the circular saw to the electric refrigerator…

…And yet… the Venture Capital scene be like…

The existence of the gender investment gap in early-stage funding is not new, especially not in the Netherlands. Even our prince, Constantijn van Oranje, is an outspoken critic of gender equality in the entrepreneurial ecosystem. According to recent research by Pitchbook and Techleap, an embarrassing 13% of all Venture Capital is invested in mixed-gender teams and less than 1% in female founder teams. That means that 87% of all capital invested flows to fully male teams… And to make matters worse, Pitchbook reports that the percentage of funding for female entrepreneurs dropped to a three-year low because of COVID-19. “In a crisis, we tend to go back and hold on to what is familiar.” Ouch 🤕

My MSc. graduation thesis inspired me to join the VC scene myself. Aspiring to be an ambassador for diversity myself and up the female percentage of investors (n=+ 👩🏼) . But one big question remains; Why is it that VC seems to be one of the last frontiers of emancipation?

To figure out what potential explanatory factors are at the origin of the gender investment gap I interviewed 24 experts: early-stage investors (Angels & VC’s) & industry experts (e.g. professors, accelerator program directors etc.). The sample included women and men such as Eva de Mol, Constance Scholten, Job Andreoli, Jacqueline van den Ende and Bert-Arjan Millenaar, and many other active players in the scene.

What we learned: 8 factors that explain the existence of the gender investment gap

1. Differences in the Entrepreneurial Personality

First, we need to understand whether the female founder is perhaps an altogether different species from the male founder. Are women perhaps not wired to be founders? A scientific study compared 16 different character traits. The conclusion was that male and female entrepreneurs hold many similar character traits. In fact, female entrepreneurs share many more character similarities with their male counterparts than with the broader female population. The only significant difference in personality between male and female founders is the degree of risk-aversion. (read more)

Many investors attest to the difference in risk aversion both in content (the ask) and in the presentation of the pitch. According to some, men tend to present bolder forecasts with more confidence – whereas women tend to present conservative (perhaps more realistic) forecasts in a more modest manner. This also translates into fundraising expectations. Women tend to ask for less capital (perhaps feeling they should/can not raise more) than men (aiming for maximization). As one interviewee rightly stated:

‘conservative projections lead to conservative investments’.

2. The lack of Female Founder Role Models

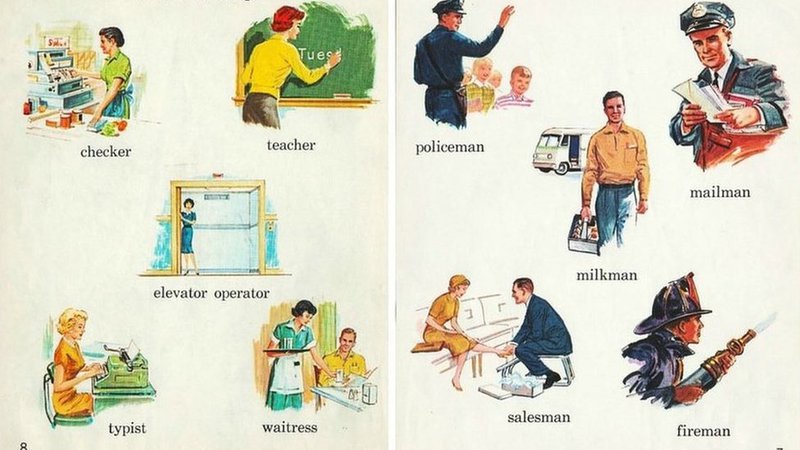

Early on, children are confronted with gender stereotypes and female underrepresentation that shape their perspective of gender-related behavior and roles. A female VC investor shared an anecdote:

‘You set a frame of expectations for what you can be in life… And you see that kids that grow up in San Francisco, they believe they can be Mark Zuckerberg and therefore they are more likely to be.

… So, if you don’t believe you can achieve a certain goal, like being a founder, because you have never been able to picture that yourself or you have never seen an image of yourself, a role-model, then you’re very unlikely to achieve that.’

The phenomenon can be described as follows: ‘If you cannot see it, you cannot be it’. The role-model effect is already visible in countries with high levels of female participation in political power, which leads to a higher number of women in leadership-roles across society (read more).

3. Limited Female Representation in the Financial Sector

Research by Fundright, 2020 shows that 87% of NL-based VC firms have 0 women investors, and only 6% of the total decision-making roles are represented by women. As human beings, we are constantly subject to biases. 350 years B.C. Aristotle already acknowledged that it is human nature to feel closer to people that are similar to oneself. This is what psychologists now understand as the Affinity bias. The ingroup-bias describes that humans tend to favorably treat others of shared identity. As the investor’s scene is still dominated by male investors, capital flows more easily to male entrepreneurs.

Another relevant bias here is the confirmation bias. Investors (men and women alike) unconsciously hold the belief that men are more successful entrepreneurs and tend to only accept or notice information that is consistent with this prior belief.

4. Differences in Promotion- and Prevention-focused Questioning

Research shows that questions directed to male founders focus on potential gain whereas questions directed to female founders focus more on potential losses. It has been proven that founders that get asked promotional questions after a pitch raise on average 7 times more capital… (read more). The most common explanation by our interviewees, for why investors ask different questions, is the more risk-averse pitching of female founders, which supposedly triggers prevention focussed questions. This relates back to #1 that describes differences in personality. It is important to be aware of the framing of questions for the investor as well as for the entrepreneur. A tip to all entrepreneurs; reframing a prevention focussed question by giving a promotion focussed answer is key.

5. Shortage of Female Founded Ventures in the VC Pipeline

Not all business ideas fit the VC business model. Venture Capitalists typically invest in tech businesses (e.g. SaaS models) which can scale exponentially to get to the promised return for investors (more info). Unfortunately, tech is a sector with female underrepresentation in general. This starts already in university. In the Netherlands for example less than 40% of students in tech are women. Later in the job market, we see only 25% of the total tech workforce and 10% of the leadership roles are fulfilled by women as published by McKinsey & Company, 2018 and CIO, 2020.

6. Education and Language Framing our Reality

Gender stereotypes are deeply rooted in our education and language. How many of us grew up with children’s books where ‘mom waves at dad as he goes to work’. What gender do you automatically picture when you think of a pilot? How about a nurse? or a CEO? Stereotypical beliefs emerge from repeated confrontation. Literature and media are lagging to present the female success and empowerment of today’s world- and create a self-fulling prophecy. Getting back to #2, How will girls imagine that they too can be a technician, a firewoman, or a CEO if they see no examples in schoolbooks or popular media?

This is not only the sad truth in primary education… Thinking back on all case studies (at least 20) we have discussed during my graduate studies (2019-2020) I can only recall Irene Roosevelt (Mondelez) as a female lead-personality. Research by HRB themselves and the Financial Times indeed found that only 9% of Harvard Business Review case-studies describe a female protagonist in a leadership position. Even in executive courses one of our interviewees indicated that in a recent course on supervisory board membership 100% of the case protagonist were male and 100% of the CEO examples were men founders. It is 2020… @Harvard please let this be a wake-up call.

7. Stereotypes of Women’s Role in Society

Many interviewees mentioned that the societal view of the roles of men and women is increasingly progressive. However, some also mentioned that investors – at the decision-making level – typically are from earlier generations who may hold more traditional beliefs of male versus female roles in society. A male angel investor explains:

‘I noticed in practice that there are many investors above 50 and 60 which lived in a different era where the position of women was different.’

Some interviewees mentioned that such traditional investors may hold stereotypical beliefs on family planning when assessing risk around future career choices of founders. They assume women to be more likely to choose building a family over running a business at some point.

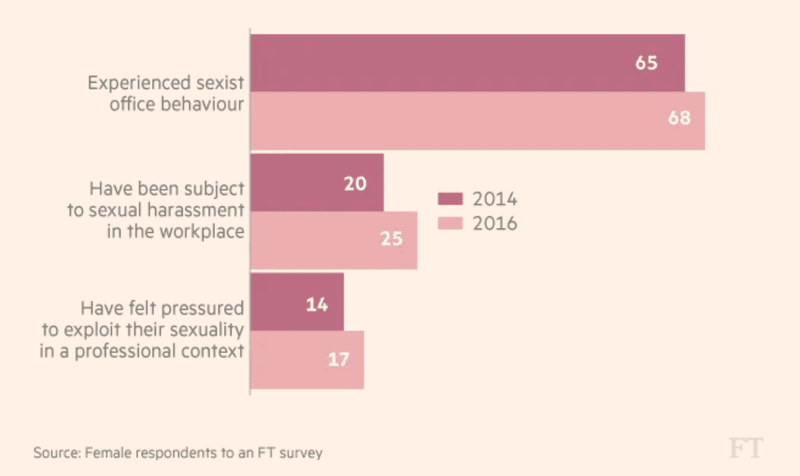

8. Sexism and Conflicting Intentions in Investor-Founder Relation

Research by FT indicates that 65% of female investment managers have experienced sexism at work. This anomaly impacts the formality of gender-mixed investor-founder relationships. Sexism impacts the scene in twofold: it discourages females to enter the sector and will hinder their fundraising ambition. A male expert expressed that he actively protects female founders by explicitly setting the rules and creating a dialogue before investor-founder meetings:

‘So we have weekly meetups between investors and start-ups. And we make it very explicit that we don’t do these meetups so that investors can get a date with a female founder but so they can invest in start-ups.’

Where Do We Go From Here?

Now that we know the reasons why the gender investment gap exists, let’s talk about how to overcome this gap. As indicated by our interviewees, part of the problem is generational and will naturally be solved over time. From research by Pitchbook, we see a slight increase in the deal count and the capital invested in female-founded ventures since 2017 (with exception of 2020). However, we need to be proactive to push the movement forward. Our research came to three areas of improvement

1. The Regulatory and Institutional Environment Needs to Create an Equal Playing Field

Not all interviewees are in favor of regulatory measures per se but considered them necessary as the market does not regulate itself.

‘I don’t like imposing laws on companies and adding regulatory burden, but society seems to be so irresponsive. Companies are incapable of making a movement themselves, thus regulatory measures might be appropriate.’

Suggestions included tax regulations, gender quotas, investment policy regulations, and labor market regulations (e.g. parental leave conditions). Interviewees mostly agreed on regulations being a temporary measure to eradicate the inequality that has built up over time.

Big powerful institutional investors (such as investment banks and pension funds) should set an example by creating an investment portfolio with diverse representation and establishing an industry-wide culture of promoting female-led companies. As explained by a male VC investor in the sample, institutional investors can further push for progressive success metrics, including societal, environmental, and diversity targets alongside profitability targets.

‘I think the younger generation is more focused on global health and wellbeing, less financially driven, and by definition, the older generations are fully male-dominated. I think the financial world is still struggling to catch up with new measures.’

Just as 130 big banks together with the UN are committing capital to climate action and sustainability in the Principles for Responsible Banking, we need a commitment for diversity.

2. Education Needs to Change Perspective

(a) Academics – To overcome gender stereotypes in education, children’s and schoolbooks as well as case studies should be evaluated and rewritten if necessary to reflect greater gender equality. Moreover, female leadership and entrepreneurship should be actively showcased to create more female role-models. Educational institutions should furthermore aim for equal gender representation in and in front of the classroom.

(b) Entrepreneurship – Some investors suggested female entrepreneurs could be given additional support e.g. on how to approach and pitch to investors, how to build the right network and how to cope with promotion and prevention-focused questions. On the other hand, it is mentioned that we need to stop treating female entrepreneurs as a niche;

‘We need to stop talking about the problem as a problem.’

(c) Investment – It is important to change the perspective of investors and make them aware of how male and female entrepreneurs might differ in their communication style as indicated by the sample (e.g. women focusing on more conservative but realistic forecasts vs. men presenting more bullish forecasts with a much lower degree of certainty/feasibility).

‘It’s about educating investors about the differences in men and women in their presentation or in how they talk about their business idea and acknowledging their qualities.’

3. Publication and Research Needs to Raise Awareness of Female Success and Empowerment

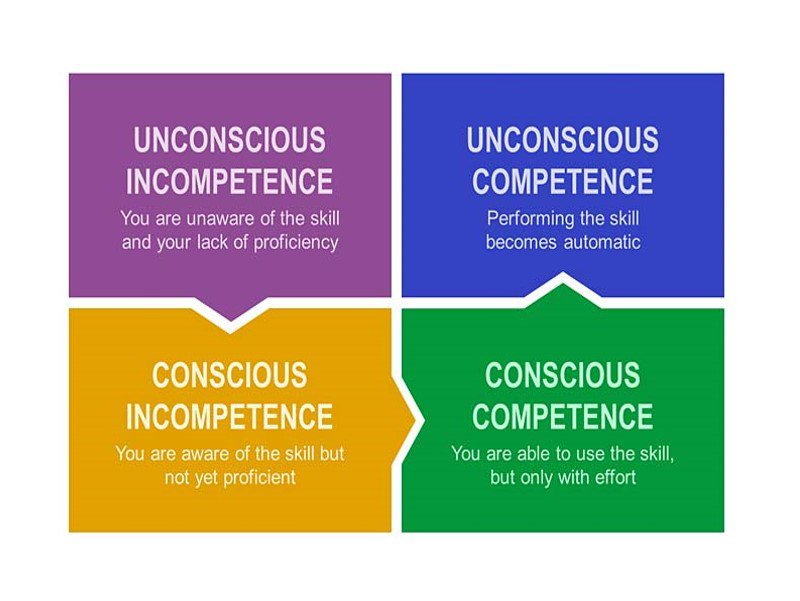

Raising awareness through media attention and research publications will help to move away from unconscious biases. The conscious competence model by Boradwell, 1969 explains four stages of learning to shift from unconscious incompetence to unconscious competence. Moving from one stage to another requires awareness, reflection, and confrontation. Ultimately, the goal is to internalize new beliefs to overcome the confirmation bias and close the gender investment gap.

This will increase young women’s awareness of entrepreneurship as a career path. However, as noted earlier, it is important to stop portraying female entrepreneurs as a niche but treat them as equal to male entrepreneurs especially in publications. A female VC investor sketches:

‘A couple of years ago, I was awarded the title of leading female founder in the start-up industry. I called the journalists and said, “You need to omit the word “female”. Otherwise, I’m out. You don’t have to write any article about me.” So, it’s the leading entrepreneur within the start-up industry. Who cares if I’m female or male? Or if I’m black or white? Because if he would have written this, people would think, “oh, what a compliment”, but it’s not a compliment, you narrow the area.’

What Can WE Do at a Personal Level?

Awareness is a start, but we need to take action to close the gender investment gap. Working as a VC analyst at Peak I have tried to put my learnings into practice. To conclude this article I would like to share with you how you & I can contribute to closing the gap from today onwards:

1. Be aware of unconscious biases

What unconscious biases do you hold? When you think of a successful entrepreneur what is the image in your head? Discover and share with others to move from unconscious incompetent to conscious competent and overcome these biases. Be aware that men and women have different qualities and often communicate differently. Both in job interviews and investor pitches, women tend to undersell themselves. Being aware of this can help you properly evaluate either performance.

2. Communicate in gender-neutral terms

In tech-speak, we constantly hear male pronouns ‘we need a product guy’, ‘I know some guys there’, and so forth. Guys = Person. It’s that easy. We need salespeople, a product manager, I know some people… Review your verbal and written communication – NDA’s, contracts, onboarding documents, lectures, pitches, etc., and ensure they are gender-neutral (people) or at least gender-inclusive (guys and girls) references. Additionally, especially in events make sure to be on stage with a diverse team presenting diverse case studies. Check content and case studies to ensure the protagonists are equally male and female.

3. Dig deeper

An often-heard concern is that people can not find enough female C-level candidates or that VC pipelines are barren of female founders. Setting internal diversity targets can help us dig deeper – e.g. find candidates outside your regular network, or try harder to recruit women into your VC pipeline. The Dutch #Fundright initiative is a step in the right direction here. With this, be aware of the questions you ask founders. As much as possible ask equal questions to equal candidates/founders. Working with a more standardized question list can help at least in job interviews – though less common in pitches.

—-

I would like to thank a whole list of people contributing to the research ‘The Gender Investment Gap in Early Stage Funding’ and this article in special Lee Weisgerber (co-writer thesis) and Jacqueline van den Ende (Peak).

Eva de Mol (Capital T), Geert van Engelen (Connected Capital), Marc Wesseling (Venture Rock), Simone Brummelhuis (Borski Fund), Constance Scholten (Slingshot Ventures), Pauline Wink (4Impact), Bert-Arjan Millenaar (NLC), Zoë Sabajo (TechLeap), Dennis Huizing (LeapFunder), Job Andreoli (Nyenrode), Jorg Kop (Utrecht Inc.), Rixt Herklots (The Next Women) and more.

Please feel free to share, respond or ask further questions!! If you wish to receive a copy of the full thesis please send an email to [email protected].