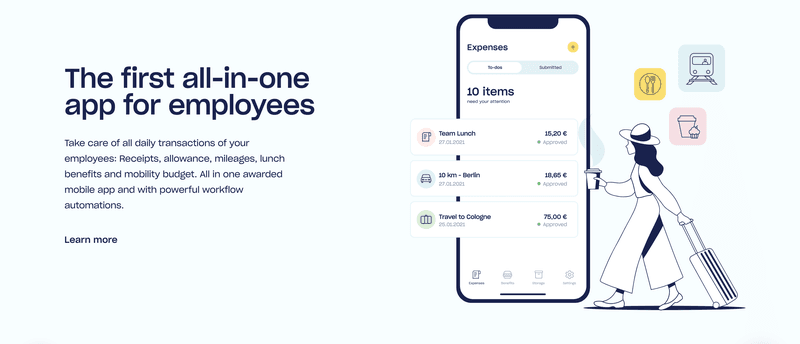

Berlin, Jan 31st 2022 – Berlin-based software-as-a-service fintech Circula announced today that it has closed a EUR 12M funding round, with venture capital firms ALSTIN Capital from Germany, Peak from the Netherlands and Storm Ventures from the US investing in the company. Existing investors Capnamic, Main Incubator and WENVEST Capital are also participating again. Founded in 2017, the startup offers companies a comprehensive employee finance app. With the help of the app, employees can digitally process expenses, for example, allowances and travel costs, and use employee benefits in a tax-compliant manner. It also provides employees with corporate credit cards with real credit lines, cashback and real-time statements, seamlessly integrated with Circula workflows.

“In the last twelve months, we have not only tripled our revenues but also laid the groundwork to become a holistic employee finance app. With our Series A funding round, we are now continuing to write this growth in more markets and are going full steam ahead with our vision to give money and time back to even more employees,” said Nikolai Skatchkov, CEO and Co-Founder of Circula.

By expanding its product portfolio, Circula offers mid-sized and large companies alike a consolidated platform for managing expenses, credit card payments, and corporate benefits in the areas that are important to every employee: meals, mobility, and home office. The product reflects the current changes in the working world: simplicity, automation, and appreciation are not only reflected in the expectations for modern products but also for employee experiences. Through continuous product enhancements, Circula has not only tripled its revenue but also expanded its customer base to 1,000 companies, including DFL Deutsche Fußball Liga, Sportscheck, McMakler, Lilium, and Ebner Stolz. From these customers, nearly half a million expenses were digitally processed in 2021 alone.

It’s been a busy past couple of weeks for the European spend management industry with fresh rounds announced. Circula stands out with a foothold in the traditional sector; 70% of its customer base are professional services and established businesses. In a highly fragmented space, Circula has a strong position to go after the majority of the European market: SMBs and mid-sized businesses that are not tech companies.

“We see Circula as the most consequent way to put employees and their finances at the center of a digital product. Since its inception, the team has not only set the standard in customer experience and simplicity but has also demonstrated impressive traction. Circula is ideally positioned to become the European tech champion for Employee Finances,”said Noel Zeh, Managing Partner at ALSTIN Capital.

With the capital from the financing round, Circula will grow its team from 50 to 120 employees, further develop its product, and enter new European markets, the first one being the Netherlands, this year.

About Circula:

Circula is a Berlin-based software-as-a-service fintech that offers companies a comprehensive employee finance app that for the first time combines fully digital employee expense management, employee benefits and a smart corporate credit card in one product. In doing so, the Circula software is optimized for seamless embedding in accounting processes and compliant with European tax standards. Circula was founded in 2017 by Nikolai Skatchkov and Roman Leicht. In total, the company raised more than EUR 20M from investors such as ALSTIN Capital, Peak, Storm Ventures, Capnamic, Main Incubator, WENVEST, Finparx and HW Capital. Circula’s 1,000 customers (as of January 2022) include Ebner Stolz, DFL, McMakler, Infarm and Orthomol.

Website: https://www.circula.com/

About ALSTIN Capital

ALSTIN Capital is an independent venture capital fund based in Munich. ALSTIN Capital invests in fast-growing technology companies that have the potential to leverage the significant market potential of the future and become market leaders. ALSTIN Capital does not only invest in convincing technology, but above all in the entrepreneurs behind the technology. ALSTIN Capital supports entrepreneurs with capital & know-how so that they can grow faster and more successfully. The basis of their investment is the conviction that entrepreneurial know-how, many years of transaction experience, international networks & sales excellence are the success factors for sustainable growth.

About Peak

Venture capital fund Peak, with offices in Amsterdam, Berlin and Stockholm, was founded and funded by entrepreneurs. Over the past 15 years, Peak has supported a variety of founders in Europe, focusing on early-stage SaaS, marketplaces and other types of platforms. Peak also invests with reputable international funds such as Accel, Point9, Project A, Insight Partners and Y-Combinator. Peak’s investment portfolio consists of 36 companies, including communication platform Trengo (which recently raised $36 million Series A funding from Insight Partners), content management system GraphCMS (which raised $10 million from OpenOcean) and international marketplace for study material StuDocu (which raised $50 million from Partech).

Read more about Peak at https://peak.capital

About Storm Ventures

Storm Ventures is a Silicon Valley based venture capital firm that focuses on early-stage investments in B2B companies. Storm has invested in leading B2B companies, including Airespace (sold to Cisco), Blueshift, EchoSign (sold to Adobe), Marketo (sold to Adobe), MobileIron, Sendoso, Splashtop and Workato. Storm has also invested in leading European startups, including Algolia, Digital Shadows and Talkdesk.