We don’t keep track of how often we get this question. But I believe at Peak we hear this one almost every day: “what revenues do I need to apply for a fundraising by Peak?”

And almost every day we give this completely vague answer: “It depends”. Usually followed by a couple of sentences that either make you believe we have no clue what we are doing, or make you believe we are very smart.

So this is a pity attempt to clarify this, for once and for all (well… or until we change our course again). For us, it isn’t just about the magnitude of your revenues, it is all about the quality of those revenues.

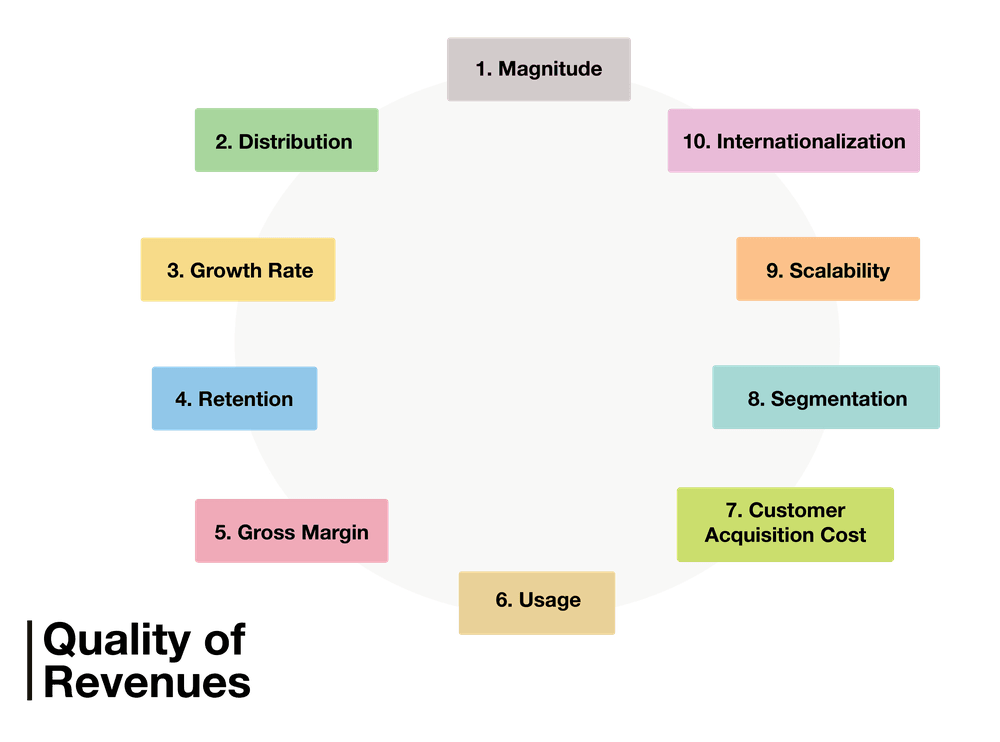

The framework that we use to assess the quality of your revenues is in a simple form as follows:

Some of these are open doors to you, but hopefully they will make you appreciate that the question is impossible for us to answer in general. We apply the framework above to companies in our focus areas: SaaS and marketplace businesses. It might be applicable in other areas as well.

1. Magnitude

OK, of course the dollar amount does matter a bit as well: if you are at zero revenues, then… well… yeah… then there isn’t much quality either. But whereas most later stage investors have a USD 100k monthly revenues threshold, we might feel perfectly comfortable at just USD 10k-20k. We believe that the riskier your sales process is (see all topics below), the more proof you would need in terms of an absolute dollar amount of revenues. This even resulted in an occasional pre-revenue investment: no quality of revenues, but if we can simulate your sales process before going live and that outlook is very positive…

2. Distribution

I always say: I prefer to have 10,000 clients paying USD 1 per month, than 1 client paying USD 100,000 per month although it is 10x as big. We want your solution to be scalable, and serving many clients is the ultimate proof of a scalable solution. A well-distributed customer base also gives you faster learnings on customer behavior and reduces the dependency on an individual customer.

3. Growth Rate

In venture capital, the most important objective of any company in my view, is growth. If there are a lot of fires burning in your startup but there is strong growth, you might still get funding. If you have everything under control but growth is absent it will be tough to raise capital. To give some guidance: we love to see startups in early stages growing at a rate of 2x – 5x year over year.

4. Retention

The most basic foundation of growth is not just adding new customers, it is to retain your existing ones. We like to take a deeper look at your revenue type: is it a one-off implementation fee (not that valuable…), a pilot (not that valuable…) or really a recurring revenue (yeah!).

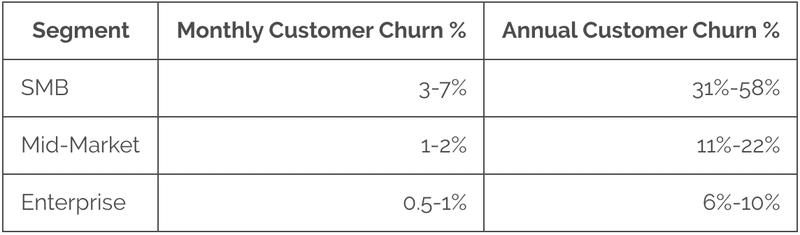

For SaaS businesses recurring revenues can clearly be measured in the form of license income. Tom Tunguz presented an insightful table of churn rates he observed for SaaS companies:

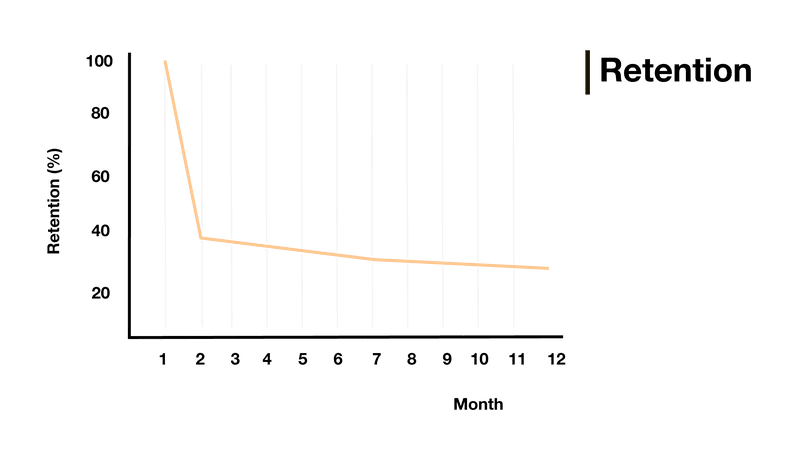

A marketplace business is most often (although not always) characterized by transactional revenues. Hence, for marketplace companies we most often see a different curve: people ‘just giving it a try’ cause a drop after the first 2 months or so of between 40-80%, but the users that stay can be very loyal (churn as low as 1-3% per month). That recurring part of those transactional revenues is where we see the most value.

The strongest form of retention is when you are able to upsell to your existing customers: they surely need or really like your product. Although it is great to look at such ‘happy-flow customers’, don’t forget that you can probably learn more from those who churned. As we love data: do track all ‘lost reasons’ of churned customers – it is a great asset to optimize your product, growth and retention later on.

5. Gross Margin

Revenues don’t mean anything if you don’t know what it costs to deliver such revenues. Even in SaaS and marketplace companies, there often is a certain variable cost that simply rises in line with your revenue growth. Almost all of our portfolio companies have costs such as customer support, hosting costs and payment fees. In a more mature phase, companies naturally focus on reducing such costs further. If a startup has its variable costs at 10-20% of revenues (what we commonly see), we typically recommend not to put too much effort in optimizing this: growing at 2-5x does way more than optimizing for e.g. 2% of your revenues.

6. Usage

We often have startups that are very bullish about the long term contracts they have been able to sell. Although that naturally is great, that is just a legal commitment of a customer to stay with you. We would rather see that such customers also have an intrinsic motivation to use your product. The great thing about SaaS and marketplace companies is that they most often know (or should know… really, I mean it, you should know) their customer behavior on their platforms. How often do clients log in? How much time do they spend on my platform? Which functionalities do they use? In addition to the generic measurement of ‘active users’ a company should also define what a truly ‘engaged / won user’ is.

7. Segmentation

There is no such thing as ‘your customer profile’. I haven’t seen any company in which all customers were the same: some of them are loyal users, some just log in occasionally. Some are large corporates, some are SMEs. Some are women, some are men. It isn’t always the easiest task, but it can be very insightful to classify your customers into ‘buyer personas’. You can often see that customers with the same buyer persona have a similar usage pattern. What buyer personas are your most engaged and valuable users and why?

8. Customer Acquisition Cost

Revenues of a company are only valuable when gross profits from such revenues outweigh the costs that were necessary for the sale. For us, revenue quality has everything to do with the CLTV : CAC ratio (customer lifetime value vs customer acquisition costs). The CLTV is the gross profit you generate over the lifetime of a customer. We love companies with a payback period of your sales & marketing spend of less than 6 months. We like companies with a payback period of less than 12 months.

9. Scalability

Always an interesting one: scalability. We see companies calling themselves ‘scale-ups’ when they just reached their third customer. We see stock exchanges listed companies still calling themselves ‘startups’. As I still don’t have a full understanding myself what truly defines ‘scalability’, I will try to bail myself out of this one with a few personal beliefs:

- Scalability would require that a company is no longer dependent on the founder to do the sales.

- Scalability requires that you know that you can toss a dollar into a certain marketing or sales channel and it will generate x times that dollar in terms of gross profits.

- Scalability of a marketplace means that you have sufficient supply matching demand and vice versa (liquidity of your platform).

- Scalability requires that you have customer churn at an acceptable rate (without long term contracts).

I think too many companies believe they are ready to scale when they are not. On the other hand, you need to grow fast and experiment a lot to find out whether your company can scale or not, so you cannot afford to wait too long either. (I know… like I said… I just tried to bail myself out of this one… and I probably failed miserably…)

10. Internationalization

If you are based in China or the US, it probably isn’t an immediate requirement. But when in Europe, it says a lot whether you have made your first steps into other territories. Although we believe that a company should be ready to go international before doing so, we love those that have succeeded in expanding internationally in a few first attempts. This proves that the problem you are solving at home also exists abroad, that your solution can match or beat the competition abroad and that you can replicate your success in other countries. But it can be hard: being known, liked and trusted in your home country doesn’t mean an easy path nextdoor. When you just thought you had overcome that ‘startup’ mode, you’re back at it all over again in that new country.

So if you are looking for funding, remember it is not about the dollar amount of revenues. While some investors might look only at growth, at Peak we highly believe in the combination of fast growth and healthy unit economics (or at least the outlook thereof): in the end, a company should grow into a profitable state.

And if you may think you need to perform perfectly on all 10 measures above: you really don’t. We like to grow with you through all the tough steps that you will encounter on your path. But: it does help significantly if you have a decent understanding of where you are on this list of 10.

Last thing: if you have the perfect team of founders, all of the above doesn’t apply: just reach out to us. 😉