We thought about a Christmas Card, but figured a new landscape would be better… and what’s more festive than the Nordics during the winter holidays?

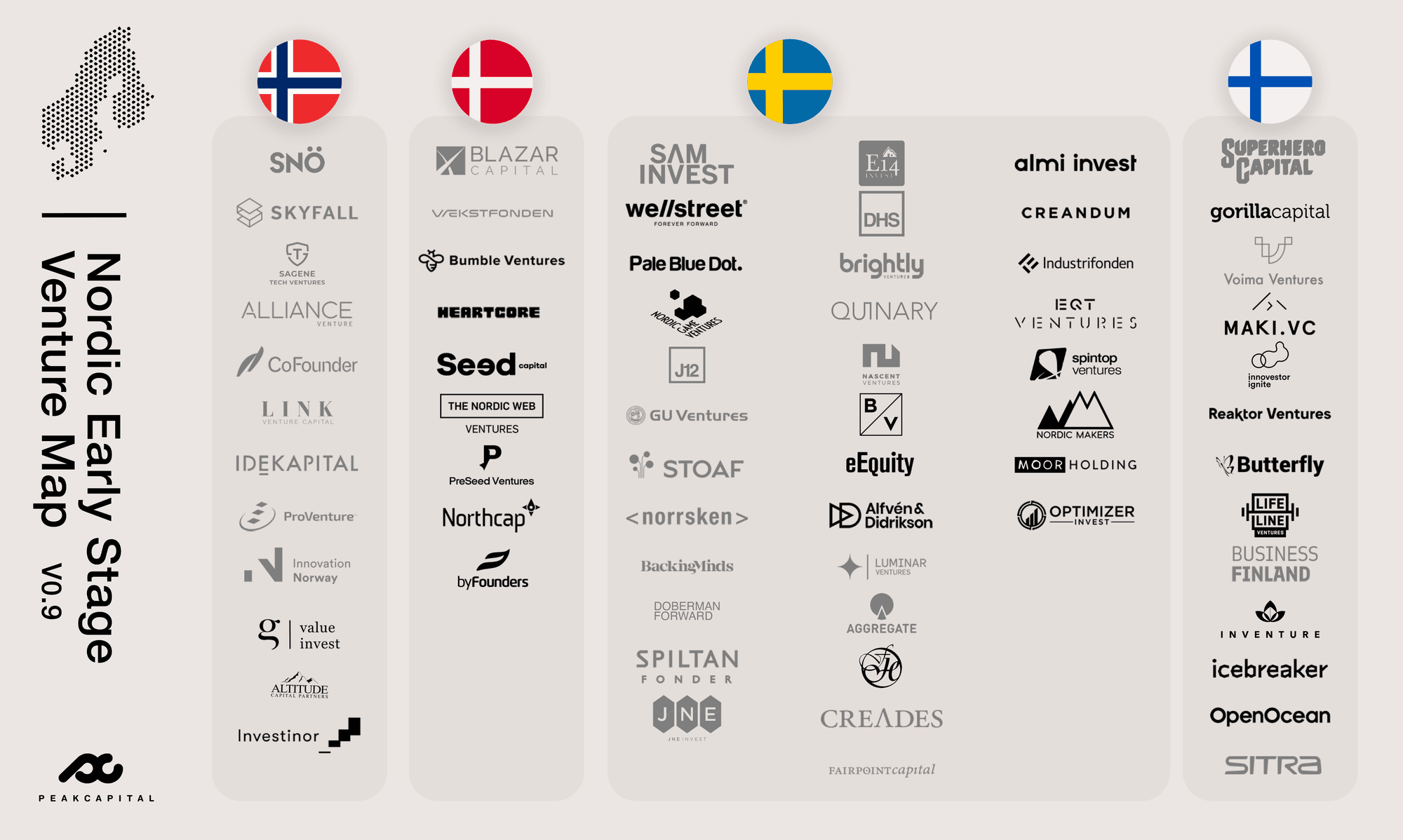

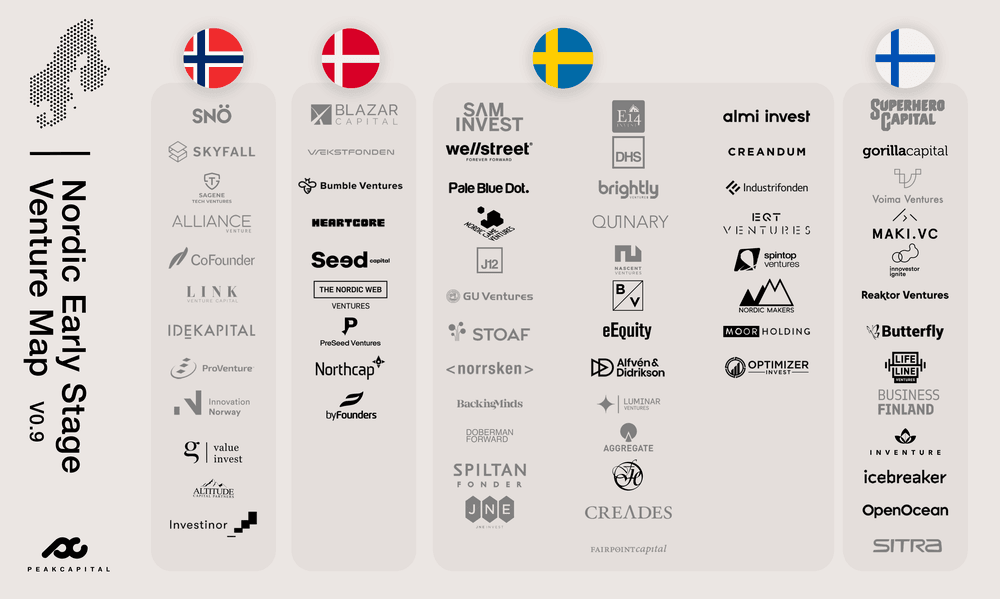

We’re happy to present: The Nordic Early-Stage Venture Capital Map!

About the Map

The map shows the active early-stage (pre-seed and seed) investors from the Nordic countries, including Norway, Denmark, Sweden, and Finland! (Sorry, Iceland! Next time). These are funds that invest with ticket sizes between 100k and under 5M, converging around 1M.

We have decided to zoom in on institutional investors in tech/software. For this reason, we have not included corporate venture capital funds (CVCs), family offices, and highly verticalized investors (ex: agriculture, health, hardware).

National vs International Focus

To help you navigate the Nordic venture landscape, we differentiated between funds that have a national and international focus (international meaning they invest Nordic/Europe/Worldwide) All of the light grey logos are funds that invest nationally (ie. A Finnish fund that invests only in companies from Finland). The funds with black logos have a wider geographic scope.

There are, of course, venture capital funds that invest in companies in the Nordics but are not themselves based in the Nordics – like us at Peak, for example. This map shows funds from and with their HQ in the Nordics.

About Our European Venture Capital Maps

Venture Capital can be an opaque and inaccessible industry for founders, ecosystem stakeholders, and even investors. We hope that these landscapes help to demystify it a bit. For more content on Europe’s venture capital scene, check out our Dutch venture map and our Benelux (Belgium & Luxembourg) venture map. We’re working on one for the DACH region too. We also map out the early-stage software-as-a-service (SaaS) and marketplace landscapes in Europe.

Reach out to us! Meet our “Chief Nordic Officer” 😉

We’re excited to become more involved in the Nordic scene and are happy to connect with founders, investors, and other ecosystem players based there. We’d love to hear from you! Reach out to Calin, our new team member and “Chief Nordic Officer.” He is laser-focused on our northern neighbors, having joined us earlier this year from Norway.

You can find him on Linkedin or via email [email protected]. Curious about Peak? Check out our portfolio, focus, or other ways to get in contact.

Suggestions?

Thanks to our team members Madeline and Calin for mapping and creating this landscape. Note that this is version 0.9: a work in progress. We need you to make it better!

Are you missing an investor? Have suggestions for improvement? We’re all ears. Let us know via this form (also attached below) so we can improve and update the map based on your input.