… and why VCs sound like a broken record when asking about a “pain point” — this is what they mean.

Content Piece by Tim Winter

This post is for:

- Founders refining their VC and sales pitch

- Founders at the ideation stage who want to better judge market attractiveness

- VC’s evaluating start-up potentials

If you are a tech founder, you have probably heard the question from investors a dozen times: What pain point are you solving, and how big is it?

Given the abstract nature of this question, the answers I receive differ a lot. This prompted me to create a guideline on how to answer it adequately.

Disclaimer: At the end of this article, I’ll provide a simple framework to determine where a business proposition ranks in the Painkiller dynamic.

Additionally, I will showcase how some of Europe’s biggest tech companies and rising stars are positioning themselves as painkillers.

Let’s start with the fundamentals:

First Question: What pain point are you solving?

In simple terms: B2B customers pay for SaaS products because they either help them earn more money or save money.

In a B2B setting, where your customers are companies, their highest priority is optimizing their P&L (Profit & Loss Statement). You, as a founder, can convince customers to use your solution by helping them achieve this goal.

In other words, the pain point you are solving in B2B SaaS will always boil down to either generating more revenue or reducing costs.

I will provide some examples of this later.

Second Question: How big is the pain point you are solving?

In simple terms: The bigger your P&L impact, the bigger the pain point is you solve for your customers = the more money your product helps generating or more costs you avoid, the bigger the pain point you solve is.

This distinction is also what separates a “Painkiller” (high P&L impact) from a “Vitamin” (low P&L impact) or a “must-have” from a “nice-to-have”.

For instance, if your solution saves or generates €1k per month, you might only be able to charge €500 for it. However, if it saves or generates €100k, you might be able to charge €50k per month.

This implication is also important for your own market sizing. An honest market sizing approach would be the number of companies experiencing a particular pain point multiplied by the P&L impact of your solution.

Now, let’s turn this theory into practice. I spoke with six founders and executives from leading European tech companies to explore how they impact their customer’s P&L.

Profit Side:

Revenue Enablement // Mollie

Being a payment service provider is quite straightforward: without them, generating revenue online would be difficult or even impossible. Hence it is no surprise that multiple unicorns in this field are competing for market share. I asked Ken Serdons, CCO of Mollie about his view on Mollie’s P&L impact as a B2B SaaS company:

“We are experts in enabling revenue capture — with more and more SaaS companies that touch money, we enable them to capture revenues from their payments. Shopify i.e. does 75% of its revenues from payments.”

Serving over 130,000 clients, Mollie stands out for its ease of implementation, making it suitable for the SME segment.

Pitching their P&L impact to clients is usually self-explanatory, which solidifies their solution as a true pain killer. “Next to revenue enablement, there is also a significant cost-saving element, as we offer extensive onboarding and KYC support, which customers don’t need to handle.”

In short, Mollie helps clients win more sales, generate more revenue, and reduce risk. As Ken put it: “It’s easier to pitch about revenues since people are always excited about growth”

Revenue Expansion // Upvest

Imagine you have a great company with a loyal customer base — then someone walks in and offers you a solution to:

- Extend your product offering and upsell your customers

- Increase engagement with your existing product

- Provide a white-label solution to integrate into your infrastructure

Sounds too good to be true? Well, Upvest offers all three. Their trading infrastructure allows neobanks, banks and neobrokers to extend stock and crypto trading products to their existing clients. Alex Reichhardt, Director of Sales, summed up their value proposition for me:

“At Upvest, the P&L impact through upsell and profit potential is our biggest selling point. A thorough ROI calculation is key.”

“In your sales pitch, you always need to bridge the gap between your story and a hard number that underscores the value you deliver. You can pitch the vision of feature X, or you can showcase the impact feature X has.”

Conversion Rate & Basket Size Improvement // Frontnow

For the last company on the profit side, let’s dive into our portfolio company Frontnow, the AI-enabled pre-sales tool in e-commerce. Their AI shopping assistant and product data enrichment tool drives revenue by increasing conversion rates and basket sizes. Their P&L impact lies in generating more revenue from your existing website traffic.

I had a chat with Marc Funk, CEO and Co-Founder, about different Ideal Customer Profiles (ICPs):

“First of all, be aware that your clients can probably build everything themselves if they really want to. Some of our clients make billions in revenue, so you have to build something that really satisfies their needs from the start. And by that, in our case this means generating revenue.”

“While generating excitement for the profit side is easier, reducing costs is more intuitive to calculate. Determining the exact attribution of a product to revenue increase can be challenging and must be an integral part of your tracking.”

“Depending on your client structure, you need a different approach when pitching your P&L impact. Traditional and large enterprises value safety and are okay with growing 1–10% annually. For them, the cost-saving aspect can be way more relevant than growth, unlike tech companies that still want to grow 100% every year.”

Cost Side of P&L

Time Savings and Insourcing of External Services // DeepL

Being from the Rhineland, I naturally had to feature one of Cologne’s biggest tech players. Customers can leverage DeepL’s AI translation services to speed up project delivery and reduce reliance on human translators, leading to lower translation costs and improved operational efficiency. Additionally, businesses using DeepL can expand into international markets more effectively, driving revenue growth and enhancing their competitive edge.

Edward Crook, Chief of Staff, DeepL: “The best SaaS solutions offer genuine impact to their users, and in the case of DeepL, that’s real-time savings on translation and communication.”

“The time required for translations can be drastically reduced from several days to a couple of minutes. This means team members can spend more time on their core responsibilities, thereby increasing their output, which has a tangible impact on a firm’s P&L.”

“Time is money might be an overused saying, but in the case of SaaS, the old adage very much holds true.”

Efficiency Gain, Employee Retention & Happiness // Neople

When we invested in Neople in 2023, we were drawn to its obvious value proposition: an AI Agent that solves customer tickets for e-commerce companies. What’s more, it improves over time, increasing the first-time-right ratio by learning from each customer interaction. Neople integrates directly into your customer service center, making it easy to implement and allowing you to save time from day one.

Hans de Penning, CEO and Co-Founder of Neople, told me about his view on their P&L impact:

“We offer multiple benefits to our customers, most of which are directly monetary: saving time by answering customer support tickets with AI. One of our key winning elements is that the ROI is easy to calculate.”

“Some effects might be more indirect, like Neople handling more unhappy customer requests, which can be draining for employees. This, in turn, increases employee happiness and retention.”

“Sometimes you see decisions being made on softer metrics — like following industry competition or improving customer experience — that ultimately still impact the P&L.”

“My advice for founders is to target something in your client’s company where the costs are well-known, as it makes the product easier to sell.”

Stay Compliant to Regulations = Avoid Losing Clients // Tanso

Regulations have always shaped the way companies do business. This usually changes how companies operate, and capturing parts of this change process presents opportunities for others. Munich-based Tanso is a climate intelligence suite that offers a solution for carbon accounting.

I really enjoyed the conversation with Founder and CEO Till Wiechmann and what he taught me about their go-to-market:

“Your first competition in a pitch is not another software, but your customers building a solution internally. So by default, you are competing for P&L impact by being cheaper or more efficient than them solving a problem with their tools and manpower”

“While the P&L impact of carbon accounting might not seem obvious initially, it’s not only about having cost-efficient processes but also about preserving and winning topline. Our customers are aware that not being able to report on certain metrics might cost them their position of being the supplier of a huge OEM, which accounts for 30% of their revenue.”

“A painkiller can only exist if a pain is felt. In sustainability accounting, 3 years ago, it was not easy to sell a pain point that your customers anticipated but haven’t experienced yet. This changed a lot now.”

“As the pressure on carbon reporting became tighter, P&L impact increased, and the importance of the topic changed for our customers. With that, our buying center became more senior and now usually involves C-Level. P&L critical decisions are made by the CEO or CFO.”

How can you determine if you are truly solving a pain point for your clients? Below is one method to help you figure it out.

The 5-Question Painkiller Checklist:

- Do you know exactly how you can impact your clients’ P&L and by how much?

- Do your clients already recognize the potential P&L impact, or do you need to educate them?

- Can your clients quantify the impact themselves, and how granular can they get?

- Does your solution provide a one-time P&L impact, or does it consistently deliver P&L benefits over the next 5–10 years?

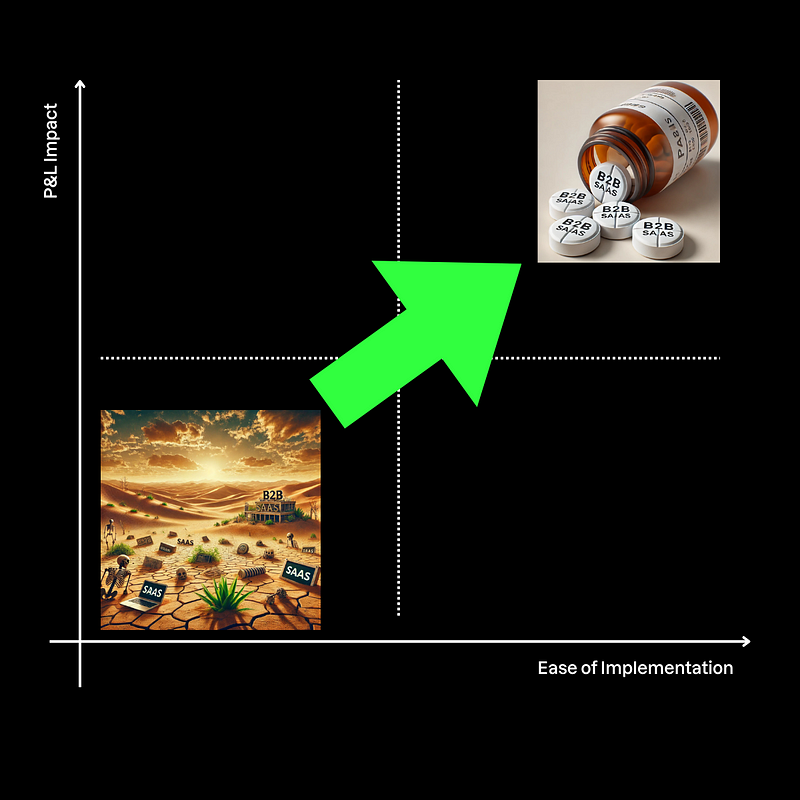

- What is the balance between the ease of implementation and your P&L impact? (see graphic below)

How to interpret the above

Top Right: If your solution is easy to implement and has a high P&L impact, you can be a true painkiller in the top-right quadrant. For example, Mollie operates in this space.

Bottom Right: Low P&L impact is acceptable if your solution is easy to implement. Ideally, it should be self-service, product-led, and have a large customer base, as you won’t be able to charge much per client.

Top Left: This can be a very lucrative field to be in. For instance, Upvest operates here. They sell to large institutions in a highly regulated environment, therefore the implementation effort is quite high but they offer significant upside potential.

Bottom Left: This is the space you want to avoid at all costs — having low monetary benefits for your clients while being difficult to implement or having a lengthy sales process. This is the death valley of B2B SaaS.